Life Insurance

Life insurance helps you plan for the unexpected. And at the Chapman Insurance Agency it doesn’t have to be complicated. Life Insurance can help replace your income and pay for things like housing, living expenses, and educational costs in the case of unexpected death by providing an income-tax free death benefit.

Life Insurance can be used for

- Funeral Expenses

- Mortgage/Loan Payoff

- Providing income for your family

- Business Continuation

- Providing an education for your children

- Paying estate/inheritance taxes

- Transferring wealth to your family instead of the IRS

- Charitable giving

Different Forms of Life Insurance

The two primary forms of life insurance are term and permanent life insurance.

Term Life Insurance

- In exchange for a premium that stays the same for a specific period, you get a tax-free death benefit to the beneficiary of your choice.

- Because it is the most inexpensive form of life insurance, you can buy large amounts without having to spend tons of money. However, it is not a permanent solution. If you need to keep the policy past the level premium period, the premiums increase dramatically.

Highlights/Key Facts

- Designed for a specific need that will last for a set period of time (term)

- Cheapest form of life insurance

- May be convertible to a permanent policy when your needs/budget change

- Builds no cash value

Similar to renting a house/apartment (you typically get no money back when policy expires/lapses)

Permanent Life Insurance

- Permanent life insurance options include

- Whole Life Insurance

- Universal Life Insurance

- Variable/Universal Life Insurance

Depending on the type of policy, it can be very flexible, offering numerous living benefits and multiple investment options.

Whole Life Insurance Highlights

- Fixed-Level Premiums

- Conservative Guaranteed cash value accumulation

- Potential for dividend/excess credit payments on some policies

- Some policies can be paid for after only a certain # of years

- Cash value growth is tax-deferred

Universal Life Insurance Highlights

- Offer Premium Payment Flexibility

- Cash value earns interest based on the company’s current interest rate

- Cash value growth is tax-deferred

- Coverage can be increased/decreased due to changing needs within policy limitations

- As your personal situations change (i.e., marriage, birth of a child or job promotion), so will your life insurance needs. Care should be taken to ensure this product is suitable for your long-term life insurance needs. You should weigh any associated costs before making a purchase. Life insurance has fees and charges associated with it that include costs of insurance that vary with such characteristics of the insured as gender, health and age, and has additional charges for riders

that customize a policy to fit your individual needs.

For Questions on life insurance, to get a quote or set up an appointment please call The Chapman Insurance Agency at 570-689-2653

GET YOUR QUOTE TODAY!

OFFICE HOURS

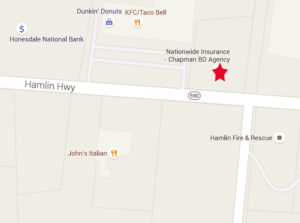

HAMLIN:

8:30 am – 5:00 pm Monday-Friday

Saturday By appointment only

Evening and weekend appointments are available.

Phone: (570) 689-2653

Fax: (570) 689-4240

24 hour claims #: 1-800-421-3535

HAWLEY:

Zeiler Insurance Building

2565 Route 6, Hawley, PA 18428

Phone: 570-226-3114

Hours: 8:30 am – 4:30 pm Monday-Friday

FEW-0459AO (5/2018)

HAWLEY